Renters Insurance in and around Newton

Looking for renters insurance in Newton?

Renters insurance can help protect your belongings

Would you like to create a personalized renters quote?

Protecting What You Own In Your Rental Home

There's a lot to think about when it comes to renting a home - internet access, size, furnishings, house or townhome? And on top of all that, insurance. State Farm can help you make insurance decisions easy.

Looking for renters insurance in Newton?

Renters insurance can help protect your belongings

Why Renters In Newton Choose State Farm

When the unanticipated break-in happens to your rented condo or home, generally it affects your personal belongings, such as a laptop, a tool set or a cooking set. That's where your renters insurance comes in. State Farm agent Kevin McMillan has the knowledge needed to help you examine your needs so that you can protect yourself from the unexpected.

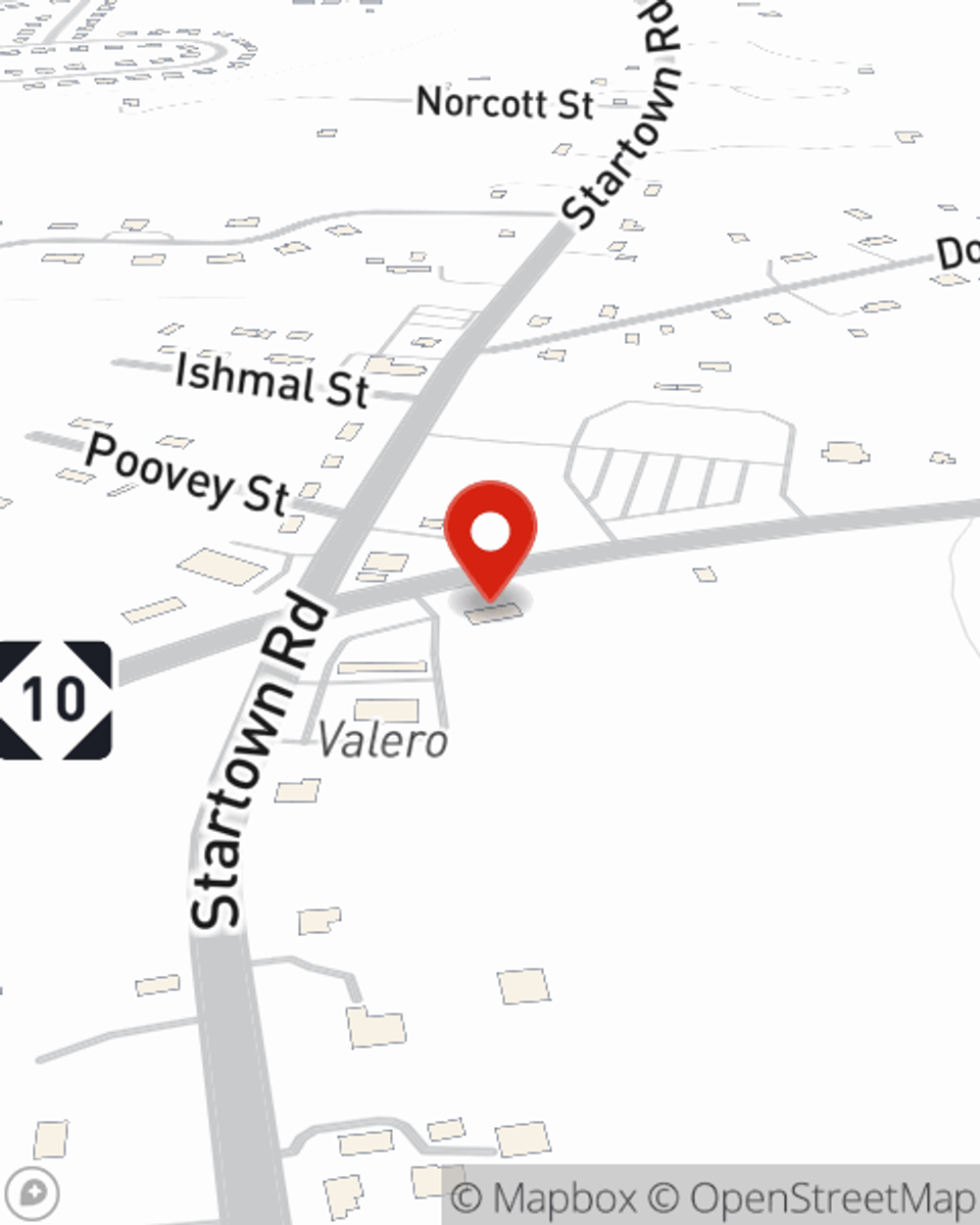

Get in touch with State Farm Agent Kevin McMillan today to see how the leading provider of renters insurance can protect items in your home here in Newton, NC.

Have More Questions About Renters Insurance?

Call Kevin at (828) 994-4475 or visit our FAQ page.

Simple Insights®

10 Washing machine maintenance tips

10 Washing machine maintenance tips

Routine washer maintenance can help reduce breakdowns and costly water damage. Learn how to clean your washing machine and more.

Is renters insurance required?

Is renters insurance required?

Renters insurance protects more than your belongings in the event of a loss. Learn about what renters insurance covers and how it can help you.

Kevin McMillan

State Farm® Insurance AgentSimple Insights®

10 Washing machine maintenance tips

10 Washing machine maintenance tips

Routine washer maintenance can help reduce breakdowns and costly water damage. Learn how to clean your washing machine and more.

Is renters insurance required?

Is renters insurance required?

Renters insurance protects more than your belongings in the event of a loss. Learn about what renters insurance covers and how it can help you.